Scanner Downtime vs. Claims Backlogs

The Real Risk for Insurers (Why Reliability Matters More Than Speed)

Insurance carriers spend a large amount every year modernizing claims operations, automation platforms, AI-based document processing, straight-through workflows, and digital FNOL experiences. Yet one of the most critical components of the claims value chain is often overlooked: document capture.

When scanners go down, claims don’t just slow down. They disconnect, fragment, and backlog.

In an industry where timeliness, compliance, and customer trust are regulated and measured, scanner downtime is not a technical inconvenience. It is an enterprise risk.

Claims Are Still Document-Intensive By Necessity

Despite aggressive digitization, insurance claims remain

document-driven:

- Property claims require repair estimates, invoices, photos, and adjuster notes

- Auto claims rely on police reports, medical bills, and third-party correspondence

- Life and disability claims require certified documents, affidavits, and medical records

- Health claims still ingest millions of scanned EOBs, referrals, and clinical records

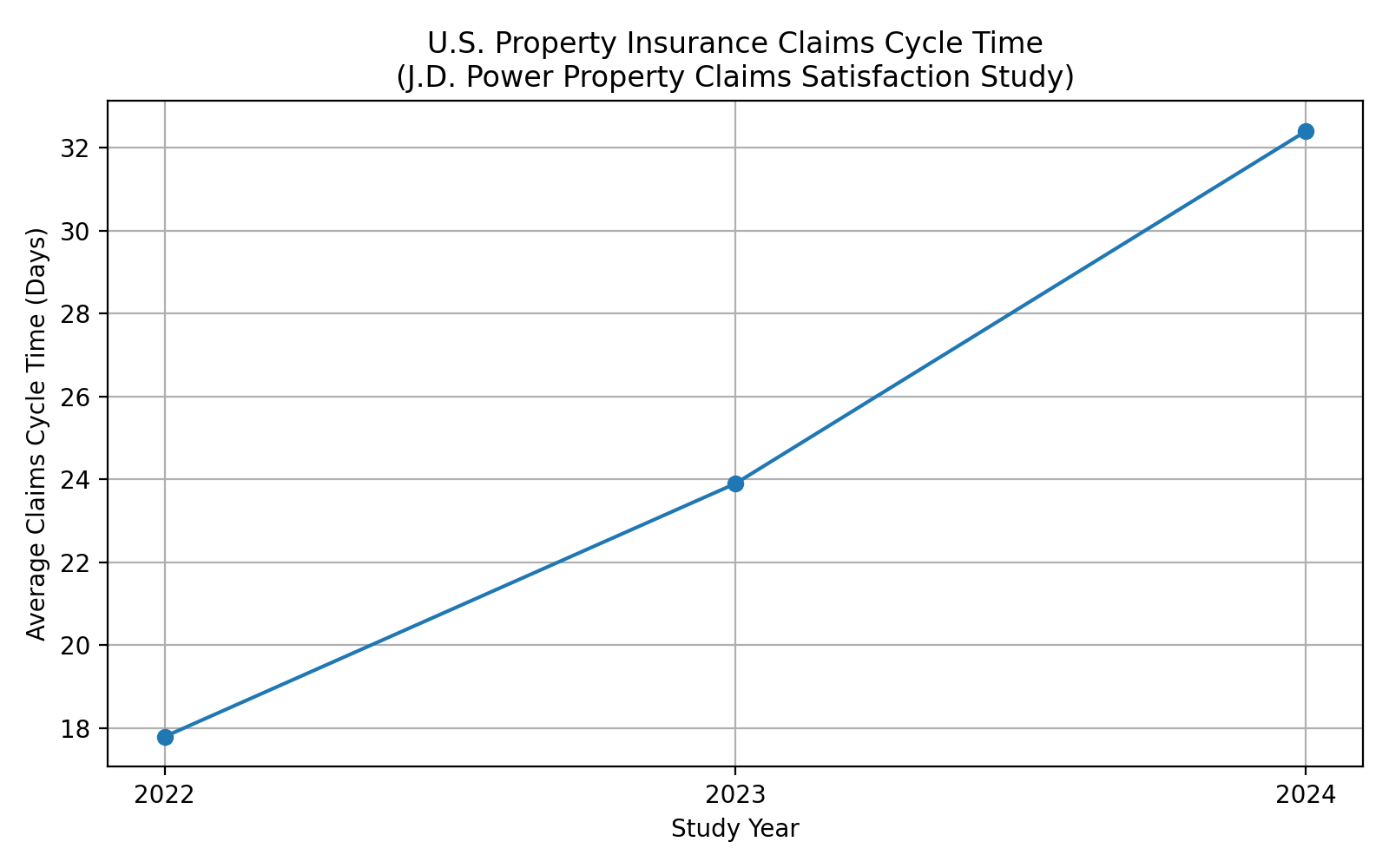

Claims Delays Are a Growing Industry Problem

Claims cycle times are already under pressure before any operational disruption.

According to insurance industry data:

- According to J.D. Power’s U.S. Property Claims Satisfaction Study, average claims cycle times have increased sharply since 2022, reaching 32.4 days in 2024–2025 the longest duration recorded since the study began in 2008. While these figures focus on property insurance, similar intake and backlog pressures affect auto, casualty, health, and life claims operations that rely on document-driven workflows.

- Property and casualty claim cycle times rose to nearly 24 days in 2024, up significantly from prior years

These delays are not merely inconvenient. They can increase:

- Loss adjustment expenses (LAE)

- Call center volume

- Customer dissatisfaction

- Regulatory scrutiny

Where Scanner Downtime Becomes a Claims Backlog Multiplier

1. Intake Failure Creates Invisible Queues

Claims operations function as queue-based systems:

- Claim is received

- Documents are captured

- Data is extracted and routed

- Adjusters and examiners act

Scanner downtime interrupts step two, but claims continue arriving.

The result:

- Physical document accumulation

- Manual workarounds

- Temporary storage outside core systems

- Re-scanning and re-indexing errors

2. Downtime Directly Increases Claims Handling Costs

Insurance-specific research consistently shows a stark cost difference between automated and manual claims handling:

- Manual claims processing costs $2.05–$10.00 per claim

- Automated claims processing costs $0.85–$1.58 per claim (Insurance claims cost analysis)

Scanner downtime pushes claims out of automation and back into manual handling, inflating per-claim costs across:

- Indexing

- Data correction

- Follow-up communications

- Rework and escalation

This cost increase rarely shows up as “scanner failure” in reports, but it appears clearly in LAE trends.

Automation Breaks When Intake Is Unreliable

Modern claims platforms depend on consistent, high-quality document ingestion. Research on intelligent document processing (IDP) in insurance shows:

- Automation improves accuracy, reduces cycle time, and lowers cost

only when input quality is stable

When scanners fail or produce inconsistent output:

- OCR confidence drops

- AI classification fails more frequently

- Exceptions increase

Straight-through processing collapses

In effect, unreliable scanning undermines every downstream technology investment.

Regulatory Risk: Delays Are Not Neutral Events

Insurance regulators do not assess delays based on the IT root cause. They assess outcomes. Claims handling requirements across U.S. jurisdictions emphasize:

- Timely acknowledgment

- Prompt investigation

- Fair and efficient settlement

Regulatory guidance highlights that systemic claims delays, regardless of cause, create compliance exposure.

In other regulated insurance markets, failure to process claims on time has resulted in multi-million-dollar penalties tied directly to operational breakdowns. Scanner downtime is rarely cited directly, but it could be one of the potential issues.

Why Speed Alone Does Not Protect Insurers

Many carriers evaluate scanners based on:

- Pages per minute

- Batch throughput

- Peak scan speed

But claims intake is continuous, not batch-perfect.

A scanner that is:

- Fast but unstable

- Fast but poorly supported

- Fast but prone to driver or software failure

Creates more backlog risk than a slower device that operates consistently. Reliability smooths intake. Speed only amplifies throughput when uptime is guaranteed.

Reliability as Business Continuity Infrastructure

For insurance carriers, scanners should be treated as:

- Claims throughput infrastructure

- Automation dependency protection

- Compliance risk controls

Key reliability factors that matter more than raw speed:

- Proven uptime in high-volume environments

- Stable drivers and scanning software

- Integration resilience with ECM and claims systems

- Rapid support and replacement response

- Failover and redundancy options

Why InterScan’s Approach Aligns With Insurance Reality

InterScan LLC positions scanning not as a peripheral tool, but as a mission-critical intake infrastructure.

For insurers, that translates into:

- Fewer document ingestion failures during peak claim events

- Stable input for OCR, IDP, and AI workflows

- Predictable claims throughput

- Lower loss adjustment expenses

- Reduced regulatory and audit exposure

In claims operations, reliability protects revenue, reputation, and regulators’ trust. At interScan, we focus on highly reliable scanners, high throughput, and excellent service.

Highly Reliable Production Scanners with High Throughput

Although our scanners are highly reliable, durable, specifically designed for the US market, and battle-tested across many industries, they are also fast and offer high throughput. This means you don't just have to settle for reliability over speed; with interScan, you can have

both.

Our scanners are FADGI and ISO 19264-1 compliant, are easily integrable in existing workflows, even at high speeds, and come in different sizes with different paper paths, so you can get the scanner that fits your business needs.

Learn more about our scanning software and AI software suite for digitization, to take your workflow to the next level.

DeskPro 3x1

The DeskPro 3x is our most compact desktop scanner, built for longevity and durability while still performing like a small production scanner.

DeskPro 6x1

The DeskPro 6x is our standard desktop scanner, between the 3x and 8x in terms of capacity and size. This model is great when speed is more important, but you are still looking for a durable, more easily manageable scanner.

HiPro 8x1

The HiPro 8x is a real large scale product scanner that can do continuous scanning due to its double input system and has a straight-through paper path for more challenging documents. This large scanner is perfect if you are looking to process large quantities of documents in your mail or scan room.

Excellent Service

Scanning goes beyond just the hardware to how it is handled. Whether it is in-house onsite training or offering fast service and support if there are any issues, service quality is an important factor in scanning uptime.

Reliability Is the New Performance Metric

Claims efficiency will not be won by faster scanners alone. It can be won with a combination of high throughput, reliability, and excellence.

For insurers serious about backlog reduction, automation ROI, and operational resilience, the most important question is no longer:

“How fast can it scan?”

It is:

“Can we trust it to scan reliably?”

Sources

- https://www.theaustralian.com.au/business/legal-affairs/cbus-admits-breaking-law-will-pay-55m-after-asic-investigation/news-story/03064c220ddc781d0afbf4cd17eda832

- https://www.wolterskluwer.com/en/expert-insights/insurers-and-claims-handling-challenges-in-achieving-compliance

- https://sprout.ai/resource/the-role-of-intelligent-document-processing-in-claims-management/

- https://www.boundai.ai/intelligent-document-processing/

- https://content.naic.org/sites/default/files/publication-rec-bu-receivers-handbook-insolvencies.pdf

https://www.jdpower.com/business/press-releases/2025-us-property-claims-satisfaction-study